kane county illinois property tax due dates 2021

The second installment of 2021 property tax bills are due on or before. Kane County Connects Staff 8292022 500PM.

Kane County Senior Resources Facebook

2021 Drainage District Summary.

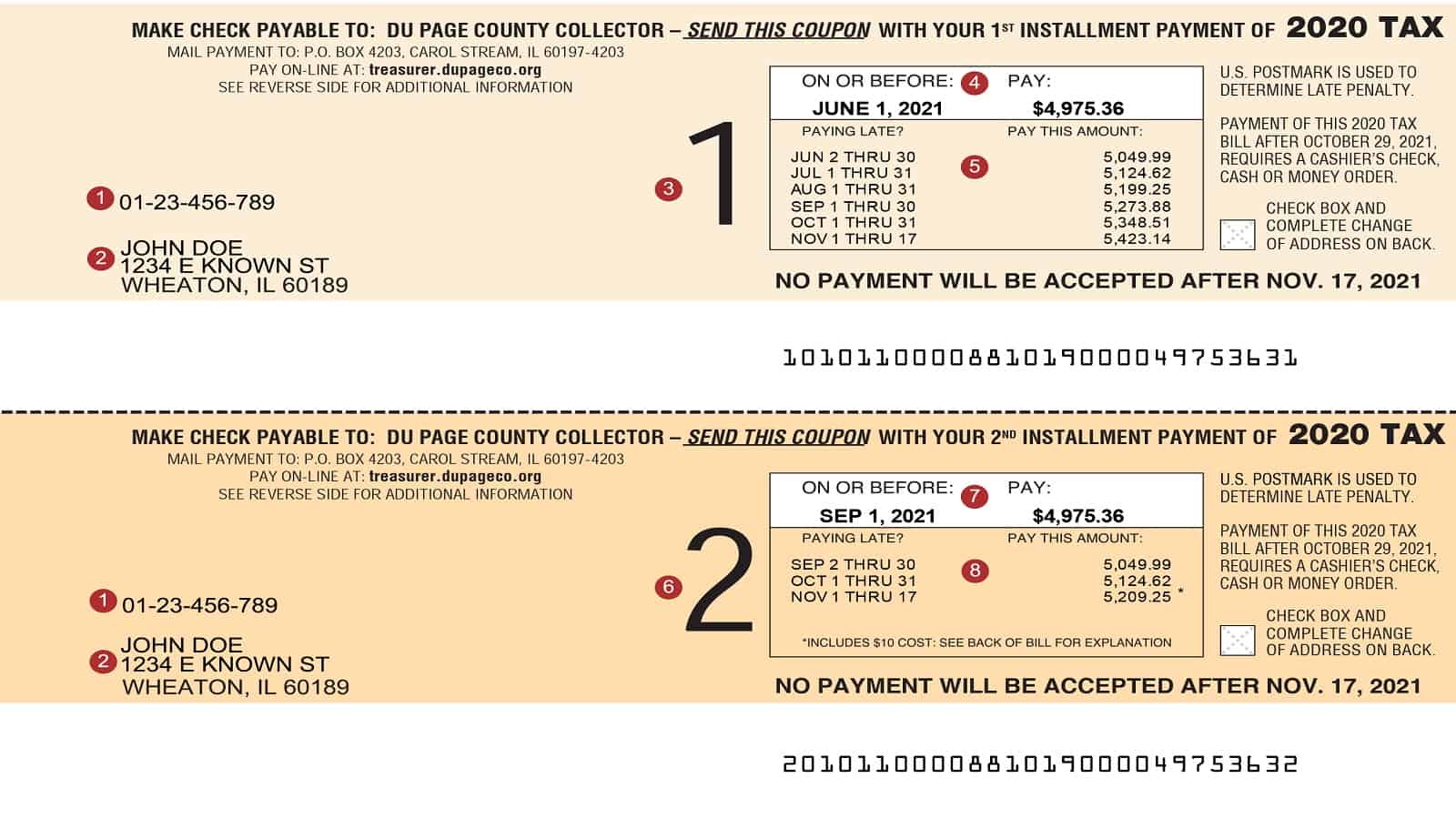

. Now rampant inflation is giving local taxing bodies the power to raise rates by 5. In most counties property taxes are paid in two installments usually June 1 and September 1. Tax Year 2021 Second Installment Property Tax Due Date.

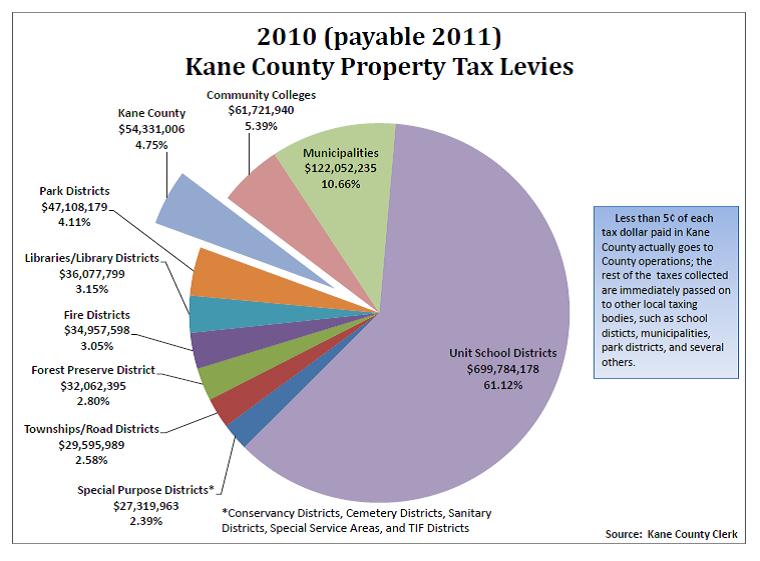

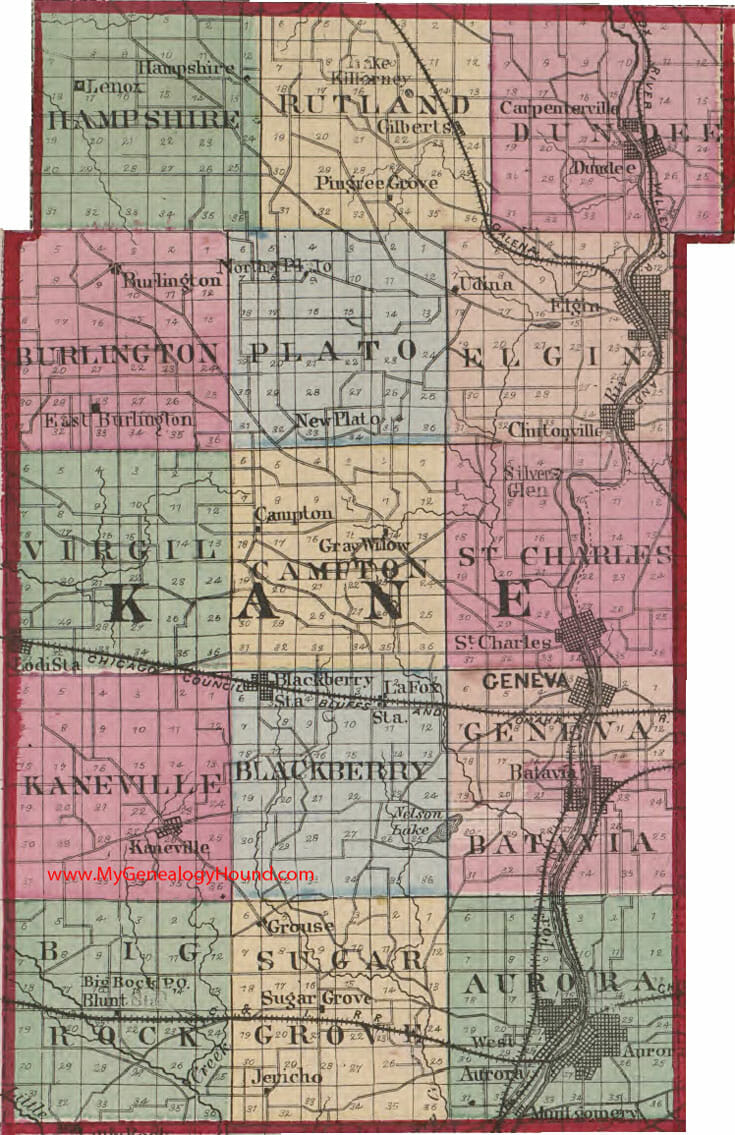

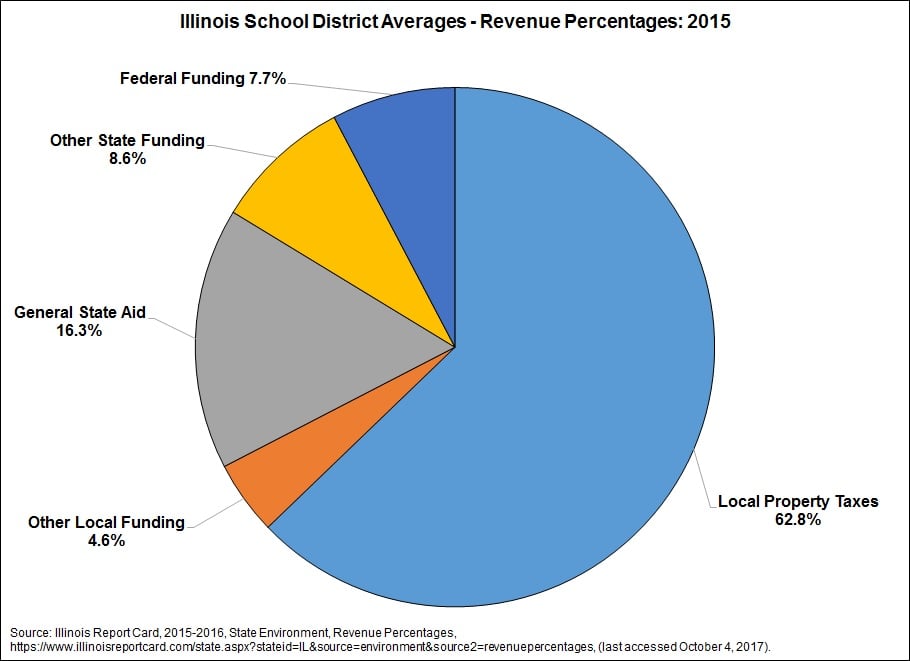

173 of home value. Annexations Disconnections Dissolutions and Organization of Taxing Districts New Subdivision Plats. Accorded by state law the government of your city public schools and thousands of various special purpose units are given authority to evaluate real property market value fix tax rates.

You may sign up with your email address to receive installment due date reminders and payment notifications for. 2021 Revised PTELL Loss in Collection by district summary. 2021 Tax Code Rate.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. You can get the 2022 application here or you can call 630-208-3818 and one will be mailed to you. 2021 Estimated EAV Report.

Illinois Property Tax Rate and Levy Manual. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. Welcome to the Kane County Treasurer E-Notify Service.

Has yet to be determined. Clerk of the Circuit Court 540 South Randall Road St. You must apply for the exemption with the County Assessment Office.

Tax amount varies by county. Illinois was home to the nations second-highest property taxes in 2021. The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill.

Kane County collects on average 209 of a propertys assessed fair. Charles Illinois 60174 630-232-3413 Mon-Fri 830AM-430PM. DUE DATES FOR REAL ESTATE TAX BILLS ANNOUNCED.

The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000. Bldg A Geneva IL 60134 Phone. MBA announces that 2021 Kane County Real Estate tax bills that are payable in 2022 are expected to be mailed on April 29.

Kane County Real Estate Tax Bills Due September 1 2022. 630-208-7549 Office Hours Monday Thru Friday. The mailing of the bills is dependent on the completion of data by other local.

Kane County Treasurer 719 S. 2021 Non Ad Valorem District Summary.

2021 Lake County Property Tax Appeals Mchenry County Lawyers

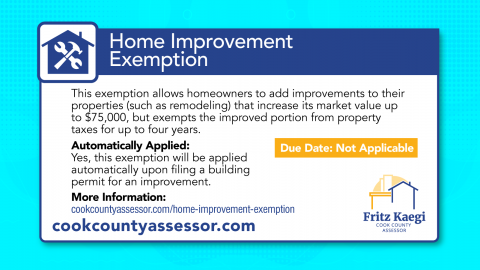

Home Improvement Exemption Cook County Assessor S Office

What S Happening In Kane County Illinois Facebook

Executor Kane County Il Free Consultation 847 628 8311

Kane County Property Tax Appeals

Dupage And Lake County Tax Bills Starting To Arrive Chicago Real Estate Closing Blog

Property Tax Rebate Program Montgomery Il Official Website

How To Fill Out Form For Illinois Income And Property Tax Rebates As Deadline Approaches Nbc Chicago

Property Taxes City Of St Charles Il

Local Governments Can Max Out Property Tax Levy Increases This Year Will They

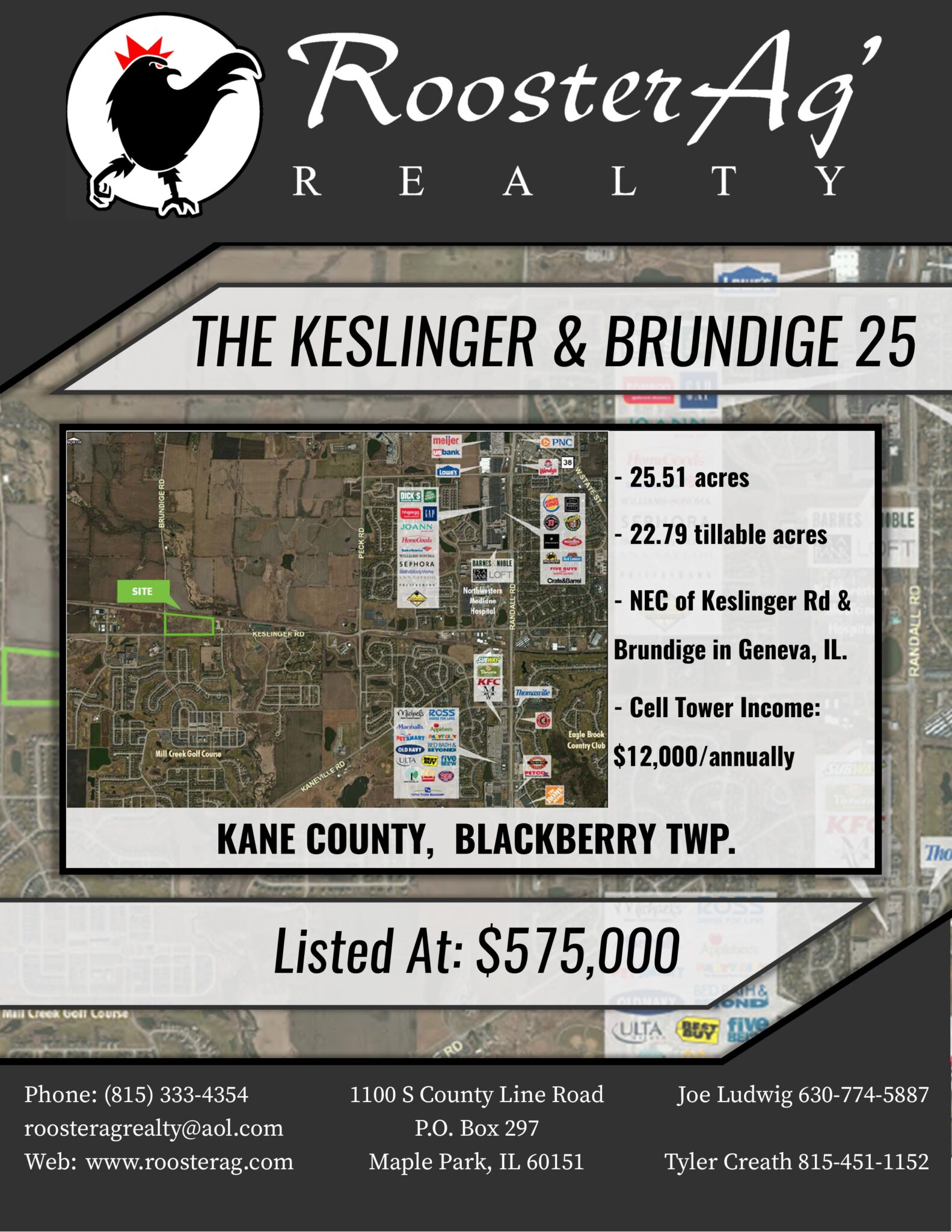

Kane County Property For Sale Rooster Ag Inc

School Districts And Property Taxes In Illinois The Civic Federation

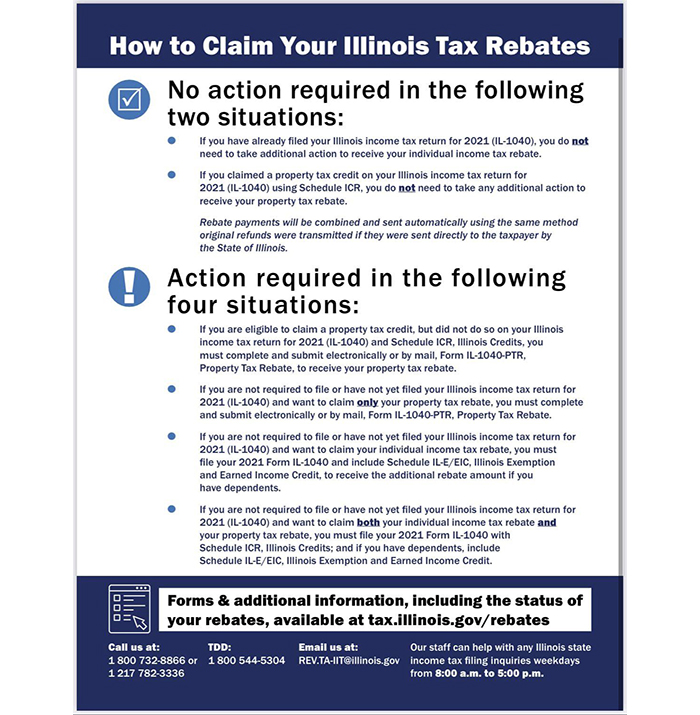

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

Elder Law Attorney Near Me Kane County Il 847 628 8311

Kane County Property Tax Inquiry

Miles Of Improvements Await Kane County Bicyclists This Spring